Taiwan Semiconductor Manufacturing Company (NYSE: TSM) won’t be a family title, however it might be the world’s most necessary firm.

TSMC, as the corporate can also be identified, makes extra semiconductors than anybody else on the planet. It is the producer that chip designers and tech giants like Apple, Nvidia, AMD, Broadcom, Qualcomm, and others all depend on.

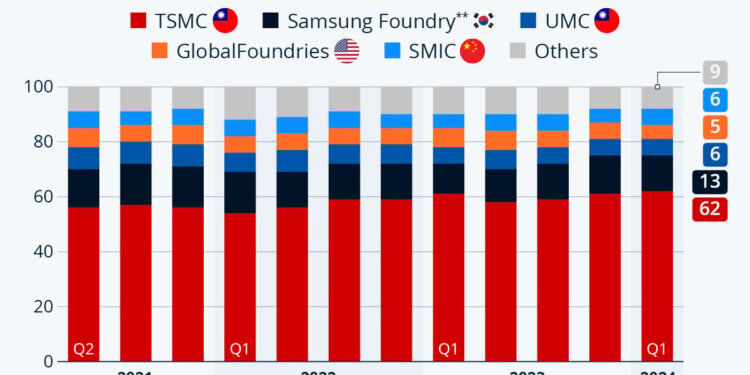

In different phrases, TSMC is a vital linchpin within the international financial system because the electronics the world depends upon would not get made with out the corporate. The chart beneath helps illustrate simply how huge a job it performs within the chip trade.

TSMC’s vast financial moat

As you may see within the chart above, the corporate controls a stable majority of worldwide contract semiconductor manufacturing. Its market share has risen slowly however steadily lately, and it is now above 60%.

Not solely that, however TSMC has a good bigger 90% market share of superior chip manufacturing. That features 3-nanometer chips which might be rapidly rising in reputation and changing into customary, in addition to superior chip packaging for bigger parts.

Corporations like Apple and Nvidia depend on TSMC to make their chips as a result of no different firm can present its capability or degree of know-how.

That benefit will not be going to go away simply as the corporate’s shut relationships with trade giants additionally give it a bonus. Even Intel, which has its personal foundry, depends on TSMC to fabricate some superior chips, displaying how entrenched its management is.

Because the semiconductor sector rebounds from an earlier post-pandemic decline and advantages from development in demand for synthetic intelligence (AI) parts, TSMC has seen income development speed up. Given its place within the foundry trade, it is best positioned to capitalize on future development in AI-related demand.

Whereas different chipmakers and cloud infrastructure firms duke it out within the rising AI area, TSMC looks like one of many best AI shares to personal as we speak because it’s already the clear chief within the foundry enterprise.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Jeremy Bowman has positions in Broadcom. The Motley Idiot has positions in and recommends Superior Micro Gadgets, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom and Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

This 1 Quantity Might Guarantee TSMC’s Market Dominance was initially printed by The Motley Idiot