The “Magnificent Seven” is a moniker used to collectively describe the world’s largest know-how companies — Apple, Microsoft, Nvidia, Alphabet, Amazon (NASDAQ: AMZN), Meta, and Tesla.

An attention-grabbing attribute of the Magnificent Seven is that every enterprise is so various and spans so many various finish markets that this megacap cohort can shed plenty of mild on the general well being of the economic system.

Traders know that two outstanding themes of the macro surroundings over the past couple of years are lingering inflation and excessive rates of interest. However simply a few days in the past on the Financial Coverage Symposium in Jackson Gap, Wyoming, Federal Reserve Chair Jerome Powell mentioned, “The time has come for coverage to regulate.”

That seems like rate of interest cuts to me. Ought to the Fed start tapering charges, I feel there is a good case to be made that every of the Magnificent Seven shares will proceed roaring.

Nonetheless, I see Amazon because the candidate with essentially the most upside. Let’s discover how modifications in financial coverage might supercharge Amazon and assess why now appears like a profitable alternative to purchase the inventory.

A brand new spark for e-commerce

Amazon’s largest income stems from its e-commerce market. The desk under illustrates annual income progress traits associated to Amazon’s on-line market over the past yr.

|

Class |

Q2 2023 |

Q3 2023 |

This fall 2023 |

Q1 2024 |

Q2 2024 |

|---|---|---|---|---|---|

|

On-line shops |

5% |

6% |

8% |

7% |

6% |

|

Bodily shops |

7% |

6% |

4% |

6% |

4% |

|

Third-party vendor providers |

18% |

18% |

19% |

16% |

13% |

|

Subscription providers |

14% |

13% |

13% |

11% |

11% |

Knowledge supply: Investor Relations.

Discover any patterns? Development over the past yr amongst bodily shops, commissions from third-party sellers, and subscriptions akin to Amazon Prime have all decelerated. Whereas gross sales from on-line gross sales have improved modestly, the quarterly outcomes have been fairly inconsistent.

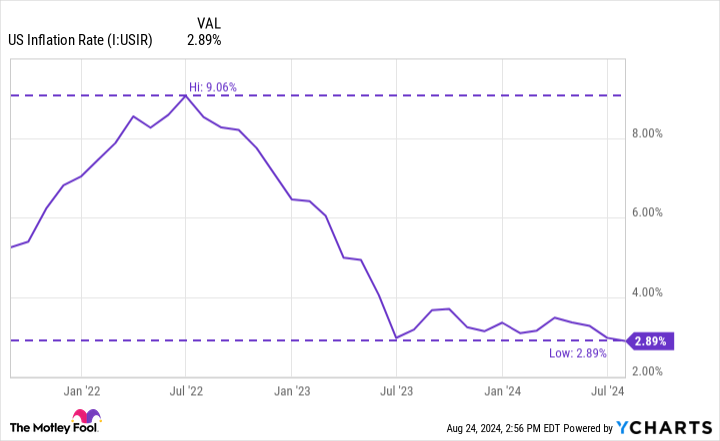

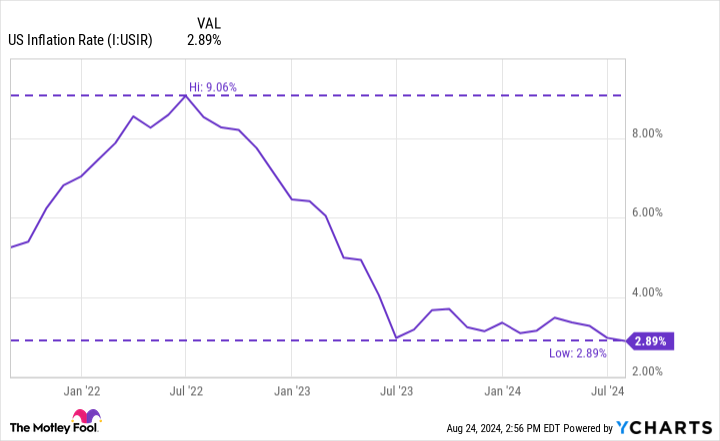

This should not come throughout as a shock, although. Though inflation cooled dramatically in 2023, inflation nonetheless lingers. Items and providers are persevering with to rise in value, simply not as quickly. Once you layer abnormally excessive inflation with rising rates of interest, it is not completely stunning to see a slowdown in on-line procuring and subscription providers.

If the Fed does introduce a fee lower in September, I feel such a transfer will probably be very nicely obtained. Even a modest discount to borrowing prices can go a good distance for client buying energy. I feel fee cuts will function a catalyst for Amazon’s e-commerce phase and ignite some newfound progress for the corporate’s largest enterprise.

Furthermore, I feel Amazon’s e-commerce partnerships with social media powerhouses look all of the extra savvy now that fee cuts look like drawing nearer.

Extra investments in synthetic intelligence (AI)

Regardless that Amazon’s e-commerce enterprise has confronted an uphill battle over the past yr, the corporate has been capable of generate progress from different sources. Particularly, cloud computing platform Amazon Net Providers (AWS) has been a serious beneficiary of the unreal intelligence (AI) revolution.

Just like my e-commerce thesis, I feel fee cuts will present companies of all sizes with some newfound monetary flexibility. In flip, AWS appears poised for some acceleration as companies proceed to extend investments in AI functions.

Why Amazon inventory appears primed to thrive proper now

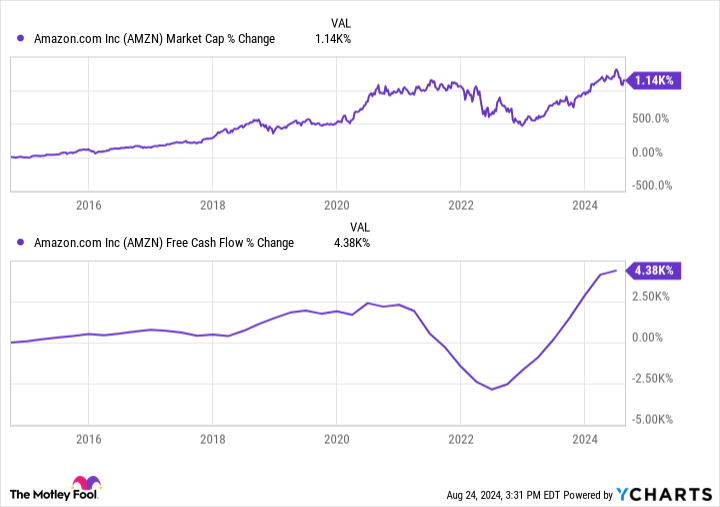

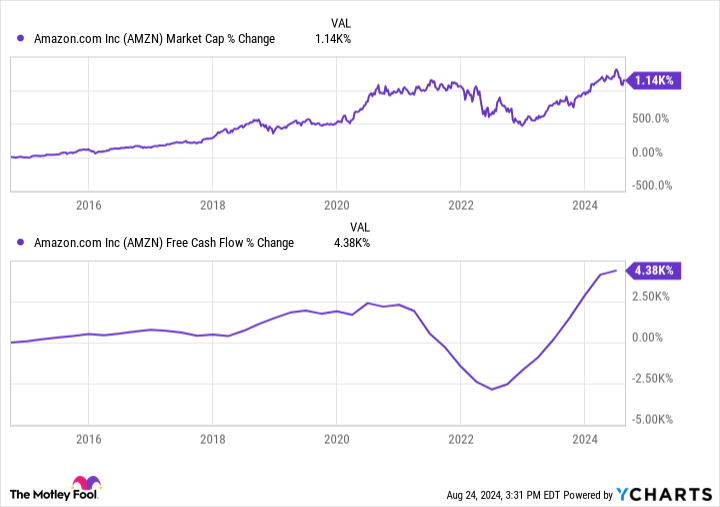

For the trailing 12 months ended June 30, Amazon generated $53 billion of free money movement — a rise of 572% yr over yr. Contemplating Amazon’s complete income is barely rising 10% yr over yr, it is unimaginable to see such a major improve in profitability metrics.

Over the past 10 years, Amazon’s market capitalization has risen about 1,140%. Over this similar time-frame, the corporate’s free money movement has grown roughly fourfold.

Amazon’s present value to free money movement (P/FCF) ratio is 38.9. By comparability, the corporate’s 10-year common P/FCF ratio is about 84. Because of this Amazon inventory is technically extra moderately priced immediately than it was a decade in the past, regardless of evolving right into a a lot bigger, complicated enterprise spanning a mess of recent market alternatives.

To me, buyers are actually overlooking Amazon inventory proper now and never completely capturing simply how rapidly the corporate can mint new ranges of profitability. Amazon has managed to develop free money movement exponentially even throughout a time of unpredictable gross sales progress, however I do not assume the present valuation totally displays this dynamic.

With a great deal of money on the steadiness sheet and the opportunity of rate of interest cuts looming, I feel Amazon’s enterprise is about to be supercharged by rejuvenated customers and companies alike, and see now as a terrific time to load up on shares.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $731,449!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 26, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

1 “Magnificent Seven” Inventory That May Go Parabolic if the Fed Cuts Charges in September was initially printed by The Motley Idiot