Journey insurance coverage is a kind of belongings you hope you’ll by no means want—however while you do, it will probably prevent from a monetary nightmare. Whether or not it’s flight delays, baggage delays, journey cancellation or interruption, and even medical emergencies overseas, having the proper bank card protection could make all of the distinction.

Nonetheless, a typical perception is that bank card journey insurance coverage solely applies if you happen to pay for the journey in full utilizing that card. However what if you happen to’re utilizing factors and miles? Do you continue to get protection on an award ticket?

The quick reply: it is dependent upon the cardboard and the kind of insurance coverage. Some advantages like emergency medical protection apply robotically, whereas others require you to cost a minimum of a part of the journey to your card.

Let’s take a more in-depth have a look at bank cards that provide insurance coverage for award journey.

Emergency Medical Insurance coverage: Simply By Being a Cardholder

One of many largest perks of premium journey bank cards is emergency medical insurance coverage. The excellent news? You don’t must pay on your journey with the cardboard for this protection to use.

Most bank cards that provide emergency medical insurance coverage cowl you just by being an energetic cardholder and travelling exterior your province or territory of residence. The protection usually applies for journeys as much as a set variety of days—often 15–25 days for these beneath 65, and considerably fewer for older travellers.

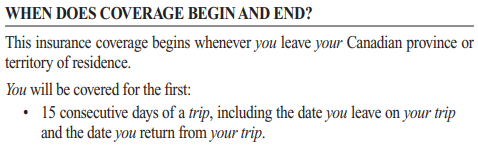

For instance, the Amex Platinum Card’s insurance coverage pamphlet states that it supplies emergency medical protection for journeys as much as 15 days if beneath 65.

The RBC Avion Visa Infinite’s pamphlet says that it covers cardholders for 15 days for if beneath 65, and three days if 65 or older.

And the Scotiabank Passport Visa Infinite Card’s advantages booklet states that it gives 25 days of protection if beneath 65, and three days if 65 or older.

As you may see, travelling exterior of your province or territory of residence is all that’s required for the emergency medical insurance coverage to kick in, and there’s no requirement for the journey’s prices to be charged to the cardboard itself.

That is the case for nearly each card on the market that features medical insurance coverage, together with the American Categorical Gold Rewards Card, the American Categorical Cobalt Card, the CIBC Aventura Visa Infinite Card, and the WestJet RBC World Elite Mastercard, amongst others.

Which means that regardless of the way you booked your journey—whether or not you paid money, used Aeroplan factors, or stitched collectively a multi-airline journey utilizing numerous rewards—you’re nonetheless lined for medical emergencies, so long as you retain one in all these premium journey bank card open.

That stated, be sure you fastidiously learn the insurance coverage pamphlet in your bank card, since there are at all times sure exclusions to which the medical protection wouldn’t apply. Most frequently, preexisting medical circumstances or endeavor dangerous actions will void the protection.

Furthermore, notice that the protection usually solely lasts for a sure variety of days in your journey, so you should still have to buy further insurance coverage if you happen to’re travelling for an extended period. You are able to do this by topping-up your bank card protection or buying a coverage from a separate supplier.

Different Varieties of Journey Insurance coverage: Use the Proper Credit score Card

Now, whereas most premium bank cards present journey medical insurance coverage to their cardholders no matter whether or not the journey was billed to the cardboard, the identical generosity is often not prolonged to different sorts of insurance coverage.

To be eligible for protection for flight delays, baggage delays, journey cancellation & interruption, or journey accident insurance coverage, you’ll most probably have to have booked the journey and paid a minimum of 75% of the portion with the bank card. This may be a problem for anybody who primarily travels on award tickets, as a flight that’s paid for with miles can’t actually be charged “in full” to any card in any respect.

Fortunately, that’s the place just a few choose bank cards available on the market can fill the hole.

Aeroplan Co-Branded Credit score Playing cards

Aeroplan co-branded bank cards lengthen journey insurance coverage advantages to any journeys booked utilizing Aeroplan factors, so long as the related taxes and costs are billed to the cardboard.

There are presently 11 Aeroplan co-branded bank cards out there in Canada, issued by TD, CIBC, and American Categorical.

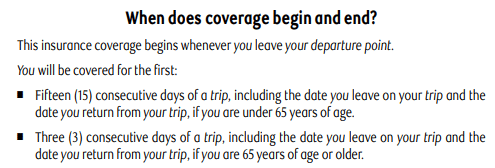

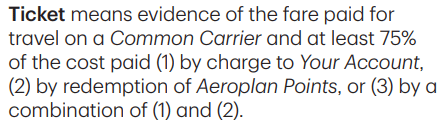

For instance, right here’s what the TD Aeroplan Visa Infinite Card’s insurance coverage bundle has to say about ticket eligibility for flight delay, delayed and misplaced baggage, journey cancellation and journey interruption, and customary provider accidents:

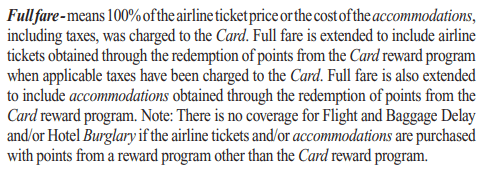

And right here’s the equal language on the American Categorical Aeroplan Reserve Card‘s insurance coverage pamphlet:

As you may see, the insurance coverage advantages on these playing cards will apply regardless of whether or not you charged the complete fare to the cardboard, redeemed Aeroplan factors for the ticket and charged the taxes and costs to your bank card, or redeemed a hybrid quantity of Aeroplan factors and money utilizing the Factors + Money characteristic.

Subsequently, whether or not you’re redeeming Aeroplan factors for a fast one-way flight or a fancy journey and also you wish to benefit from the full insurance coverage safety of a premium journey bank card in your journey, then it’s finest to place the taxes and costs onto one in all Amex, TD, or CIBC’s Aeroplan-affiliated playing cards.

And if you happen to often journey on Aeroplan factors, you would possibly discover it worthwhile to repeatedly hold one in all these playing cards open for the aim of giving your self some peace of thoughts alongside your points-funded journeys.

Credit score Playing cards with Different Loyalty Packages

Most Canadian bank cards which have a loyalty program related to them will usually lengthen their insurance coverage advantages to journey booked by means of that particular factors program as effectively. A couple of examples are as follows:

Subsequently, everytime you’re trying to redeem one of many main Canadian factors currencies for a flight, you’ll often be capable of benefit from the insurance coverage perks on no matter bank card is related to that factors program (which might be the cardboard that you just had used to earn the factors to start with).

And if that plan doesn’t work out for some purpose, you may at all times cost the remaining steadiness to a different card as a fallback possibility…

A Credit score Card That Covers All Reward Bookings

In Canada, the Nationwide Financial institution® World Elite®Mastercard® is the lone bank card that covers all reward bookings.

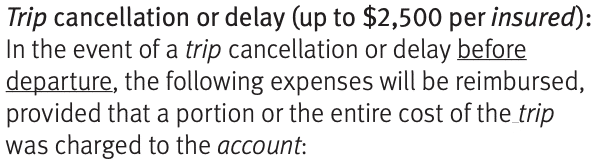

The insurance coverage protection for the Nationwide Financial institution® World Elite® Mastercard® doesn’t mandate that the full value of the journey be charged to the cardboard, however reasonably solely requires {that a} “portion or the complete value of the journey” is charged to be adequate for protection.

Which means that everytime you’re redeeming any kind of rewards currencies for a flight, be it with Aeroplan factors, Cathay Pacific Asia Miles, Alaska miles, Air France/KLM Flying Blue miles, or Ethiopian Airways ShebaMiles, you’ll be eligible for insurance coverage protection with the Nationwide Financial institution® World Elite® Mastercard®, because you’re fulfilling the criterion of “partial value” in doing so.

This card’s far-reaching insurance coverage proposition is without doubt one of the explanation why you would possibly want to decide it up and/or maintain onto it in the long run.

Conclusion

In the event you primarily journey on factors, you don’t must sacrifice insurance coverage safety—you simply want the proper bank card.

Emergency medical insurance coverage is usually energetic so long as you’re touring out-of-province and your card account is in good standing. In the meantime, utilizing a co-branded bank card by means of TD, CIBC, American Categorical, or RBC can often deal with the remaining sorts of protection.

For many who need the final word peace of thoughts, the Nationwide Financial institution® World Elite® Mastercard® stands out as the only option, providing insurance coverage safety on any award reserving, whatever the loyalty program used.

Whether or not you’re a seasoned factors collector or simply getting began, ensuring you have got the proper bank card in your pockets might help guarantee your travels go easily, even when the sudden occurs.