We’ve all been there earlier than: you’re in a rush to pay for one thing, and immediately, you surprise in case you’ve used the correct bank card.

Through the use of the correct card, you’d be maximizing your incomes potential on each expense. Many bank cards supply multipliers, or extra factors, on particular classes of spending, which implies that one bank card could supply extra factors relying on what you’re shopping for.

In Half 1, we’ll give attention to playing cards issued by American Categorical, whereas in Half 2, we’ll check out playing cards issued by different banks.

(For simplicity’s sake, we’ll solely give attention to Canadian playing cards that earn airline factors currencies or their equal, versus money again playing cards or different sorts of factors currencies).

Begin with Your Objective

Earlier than tackling spend multipliers, one has to think about what sort of factors forex or currencies you need to accumulate. If you happen to’re unsure, begin by asking your self these few questions:

- The place do I need to journey?

- Which airline do I want to journey with?

- Which factors currencies can I take advantage of to make my redemption occur?

If you happen to don’t know the place to start, then an internet site like FlightConnections is a good place to start out.

First, select your vacation spot or origin to see which airways fly out and in of every. Subsequent, work out which alliances they’re part of, or which factors currencies can be utilized to redeem for that individual airline.

When you’ve figured that out, the subsequent inquiries to ask are:

- Which bank cards earn the purpose currencies I would like?

- The place do I spend my cash?

- Is there a card that earns the purpose forex I would like that provides a multiplier for my spend?

Demystifying Spending Classes

Beneath is an inventory of the most typical classes that bank cards supply multipliers on:

- Eating, drinks, meals supply. This class consists of eating places, espresso outlets, Uber Eats, and DoorDash.

- Groceries. Who doesn’t spend cash on groceries? Take notice that some playing cards embody grocery shops as part of eats and drinks, whereas others don’t.

- Journey. This class consists of flights, motels, automotive leases, cruises, and even excursions.

- Transportation and gasoline. Some playing cards supply multipliers on gasoline solely, whereas others supply multipliers to be used of rideshare companies, buses, taxis, and public transportation.

- Workplace provides and electronics. These embody spend on shops corresponding to, however not restricted to, Apple, Greatest Purchase, and Staples.

- Drug shops. These typically embody standalone drug shops like Consumers Drug Mart and Rexall. It usually doesn’t embody pharmacies nestled inside an even bigger institution, like a pharmacy positioned inside a grocery retailer or inside Costco.

- Streaming subscriptions. These are more and more fashionable, and embody Netflix, Disney+, and different such companies.

- Leisure. This class typically consists of films, theatrical performances, and gross sales by ticket businesses. Sadly, theme parks don’t usually fall below this class.

As you possibly can see, most of the issues we spend cash day-after-day on may be incomes you further factors – if in case you have and use the correct card.

Which American Categorical Credit score Card Ought to You Use?

One necessary consider all that is which bank cards are accepted by your service provider. Within the Canadian card recreation, it usually boils right down to whether or not they take American Categorical or not.

In the event that they do, it’s nice information, as a result of there are plenty of incomes alternatives right here. In the event that they don’t, you’ll have to take a look at your backup choices issued by Visa or Mastercard.

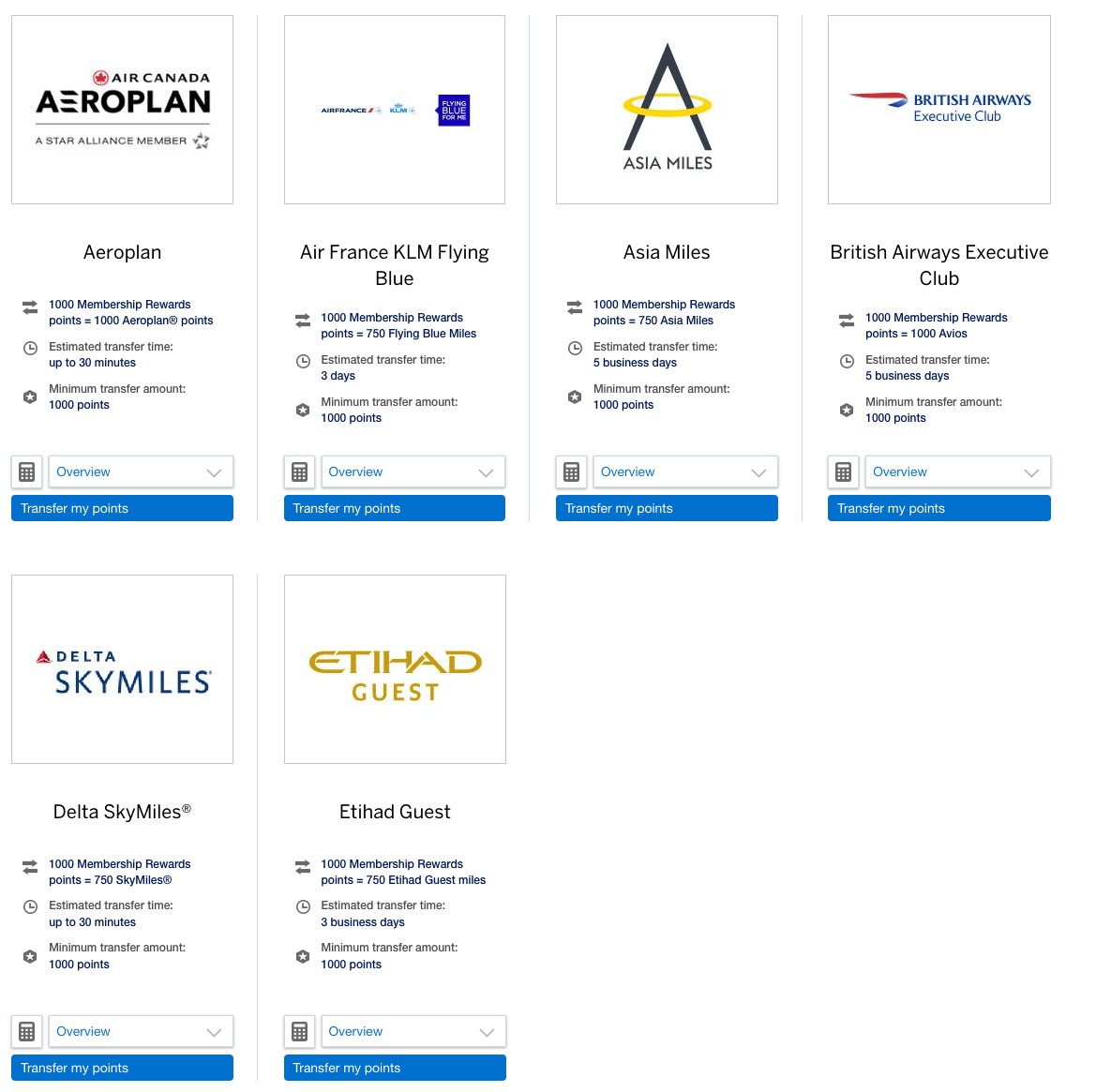

Amex playing cards earn their very own factors forex, often known as Membership Rewards (MR) factors. Canadian-issued Amex MR factors can thus be transferred to 6 totally different airline loyalty packages, making it among the many most useful factors currencies right here in Canada.

In the meantime, co-branded Amex playing cards will earn their affiliated companion’s forex. In Canada, there is just one airline with an Amex co-branded card: Air Canada.

Let’s have a look now at which Amex playing cards present multipliers on particular classes of spend. Except indicated, spend in all different classes may be in any other case assumed to earn one level per greenback.

|

American Categorical Platinum Card |

|||

|

American Categorical Gold Rewards Card |

|||

|

American Categorical Inexperienced Card |

|||

|

American Categorical Cobalt Card |

|||

|

American Categorical Enterprise Platinum Card |

|||

|

American Categorical Enterprise Gold Rewards Card |

Every little thing else, in case you spend $20,000 per calendar quarter |

||

|

American Categorical Enterprise Edge Card |

|||

|

Workplace provides & electronics |

|||

|

American Categorical Aeroplan Card |

|||

|

American Categorical Aeroplan Reserve Card |

|||

|

American Categorical Aeroplan Enterprise Reserve Card |

|||

|

Journey (motels & automotive leases) |

|||

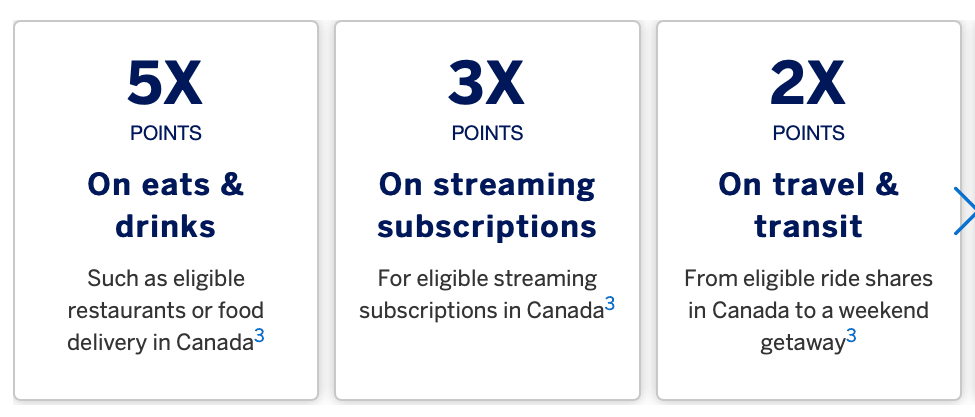

The Cobalt Card is a stable card on the subject of eating, drinks, and groceries. No different Amex card earns you 5x factors on this class inside Canada.

Relying on how a lot you spend on this class (as much as a month-to-month most of $2,500), it may simply offset the low month-to-month price of $12.99. As well as, it’s the solely Membership Rewards card to offer a multiplier for streaming subscriptions.

The Enterprise Platinum Card is nice for on a regular basis spend because it earns 1.25x on all the pieces.

Nonetheless, if your small business can spend precisely $20,000 every quarter per yr, the Enterprise Gold Card is a stable possibility as effectively because of its quarterly bonus of 10,000 MR factors for reaching that spend threshold, particularly on condition that it has a decrease annual price than the Enterprise Platinum.

If you happen to’re solely seeking to accumulate Aeroplan factors and fly primarily with Air Canada, then the Aeroplan Reserve Card offers you a minimal of 1.25x factors per greenback on all non-category spending, along with its different multipliers. On the enterprise facet, the Aeroplan Enterprise Reserve Card additionally shares the identical 1.25x non-category spend multiplier.

When you’ve got plenty of digital or workplace provides bills with your small business, then hopefully you maintain the Enterprise Edge Card, which is the one card to offer multipliers on these classes, and for the low annual price of $99. Sadly, this card is now not open to new functions.

If journey for work or leisure makes up an enormous proportion of your spend, then the Gold Rewards Card used to be a stable card for journey with its 2x multiplier.

Nonetheless, for the reason that Platinum Card earns 2x on journey, however comes with higher journey insurance coverage and an annual $200 journey rebate, it’s a little bit of a toss up – which brings us to the subsequent level.

Different Issues

The belief within the above chart is that you just maintain all of the Amex playing cards and easily want to decide on between them primarily based on the multipliers. The fact, nonetheless, is that you could be solely have or need to maintain one, two, or just a few Amex playing cards.

Earlier than leaping to the conclusion of which card is the higher one to have primarily based solely on its incomes charges, you need to contemplate the join bonus with a brand new card, its annual price, and any extra advantages with the cardboard that add to its worth.

For instance, the incomes charge for eating on the Platinum Card is barely 3x in comparison with the Cobalt Card’s 5x. Nonetheless, the Platinum Card consists of superior insurance coverage insurance policies, Precedence Go lounge entry, elite standing with a number of resort chains, and a $200 annual journey credit score, whereas the Cobalt doesn’t.

For all these extra perks, you’ll be paying an annual price of $699 for the Platinum Card, whereas you’ll solely pay $155.88 yearly ($12.99 every month) for the Cobalt Card. Which one you put money into will rely in your private spend and journey habits.

Many individuals discover it beneficial to carry each, however finally, every particular person must weigh the price of every card with the advantage of its multipliers to determine which card they need to have, hold, and use.

Service provider Class Codes

To wrap issues up, it’s necessary to know Service provider Class Codes (MCCs) and why they matter.

Infrequently, you might anticipate to get a multiplier on a purchase order since you really feel a service provider falls below one of many above classes, however the multiplier doesn’t come by way of. This might be as a result of the service provider has registered themselves below a unique kind of enterprise than you anticipated.

All retailers are required to register their enterprise below an MCC. An MCC is a quantity that identifies the kind of enterprise a service provider is engaged in and it’s what bank card corporations use when awarding multipliers.

For instance, the MCC for a restaurant is “5812”. If you happen to dine at a service provider that primarily does catering but in addition serves meals on the facet, and don’t get the multiplier, it might be that the service provider has categorised themselves as a caterer, which has the MCC “5811”, slightly than a restaurant.

On this case, you received’t get the restaurant multiplier.

Conclusion

Hopefully after studying this, you’ll seize the correct Amex card to pay in your subsequent buy. You’ll nonetheless need to do a little bit of leg work to see which card has one of the best cost-benefit ratio, regardless of understanding which has one of the best categorical multiplier.

If you happen to nonetheless can’t hold monitor of all of it, be at liberty to bookmark this text for future reference.

Nonetheless, we all know that American Categorical isn’t all the time accepted by sure retailers, so it’s necessary to pay attention to multipliers on non-Amex playing cards and the way they could play a task on this decision-making course of.